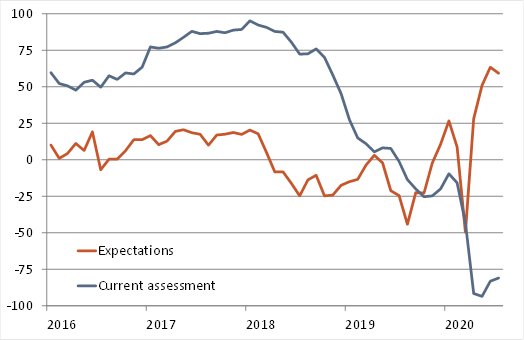

Sky-high expectations normalise: Following their surge over the previous three months, expectations among the ZEW panel of financial analysts have started to normalise. After shooting up by 77.7 points in April from a low of -49.5, following previous gains of 22.8 in May and 12.4 in June, the ZEW 6-month ahead expectations subindex slipped by 3.4 points in July – to 59.3 points from 63.4 in June (see Chart 1). While changes in ZEW expectations can highlight future turning points in the underlying economy, the decrease in June is probably too small to matter much.

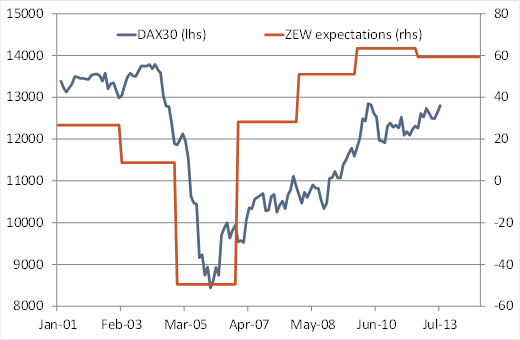

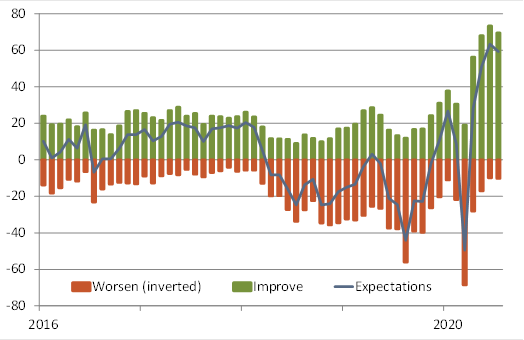

Expectations almost naturally had to come down. First, gains in equity markets which drive the ZEW panel more than other surveys have recently slowed – to 3-4% mom over the past 30 days from 10% in the 30 days before the publication of the June ZEW survey. And, while the DAX30 recovery has been quite remarkable since mid March, the recovery in the ZEW expectations dwarfs it (see Chart 2). Second, at the trough in April, sentiment among panellists improved dramatically, from sheer panic to optimism. Fast forward three months and most panellists are already in the optimist camp (see Chart 3), limiting the space for the ZEW expectations index to improve further. Also, as actual conditions have improved over the past few months, there is naturally less space to expect things to improve further.

Pessimists’ camp remains small: Reassuringly, most of those that left the optimists’ camp (down by 3.8% to 69.5%) ended up in the “no change” camp (up by 3.5% to 20.3%), rather than expecting things to worsen (see Chart 3). The only very small increase of pessimists from 9.9% to 10.2% suggests that (so far) only a few believe that regional virus hotspots in Europe or a rising curve in the US present a risk to the rebound.

Underwhelming rise in current conditions: The ZEW index for current conditions gained for the second month in a row, from -83.1 points in June to -80.9 in July (see Chart 1), reflecting the gains in the hard data (retail sales, industrial production and exports) in May. The rise, however, fell short of markets’ and our expectations. Market expectations at -65 points got ahead of themselves. The current conditions subindex, however, also clearly undershot our below-consensus call of -70. We should not overinterpret the numbers, though. The ZEW current conditions index does not closely track changes in GDP. Still, the underwhelming rise highlights the risk that, after a strong rebound in activity in May and June, the pick-up in activity could slow more materially than we think during Q3. At the moment this is just a risk, though.

Chart 1: German ZEW expectations versus current assessment since 2016 |

|

Source: ZEW, Berenberg |

Chart 2: German ZEW expectations and DAX30 in 2020 |

|

Daily data forDAX30. Monthly data for ZEW. Source: Deutsche Börse, ZEW, Berenberg |

Chart 3: Hardly any pessimists |

|

The value for the ZEW sentiment indicators is the ppt difference between the percentage of optimists (“improve”) and pessimists (“worsen”) among panellists. Source: ZEW, Berenberg |

Florian Hense

Economist

BERENBERG

Joh. Berenberg, Gossler & Co. KG

London Branch

60 Threadneedle Street

London EC2R 8HP

United Kingdom

Phone +44 20 3207 7859

Mobile +44 797 385 2381

Fax +44 20 3207 7900

E-Mail florian.hense@berenberg.com

Joh. Berenberg, Gossler & Co. KG is a Kommanditgesellschaft (a German form of limited partnership) established under the laws of the Federal Republic of Germany registered with the Commercial Register at the Local Court of the City of Hamburg under registration number HRA 42659 with its registered office at Neuer Jungfernstieg 20, 20354 Hamburg, Germany. A list of partners is available for inspection at our London Branch at 60 Threadneedle Street, London, EC2R 8HP, United Kingdom. Joh. Berenberg, Gossler & Co. KG is authorised by the German Federal Financial Supervisory Authority (BaFin) and subject to limited regulation by the Financial Conduct Authority, firm reference number 222782. Details about the extent of our regulation by the Financial Conduct Authority are available from us on request. For further information as well as specific information on Joh. Berenberg, Gossler & Co. KG, its head office and its foreign branches in the European Union please refer to http://www.berenberg.de/en/corporate-disclosures.html